The Bells of August – Fat Tail Daily

One day, when the Dow/Gold ratio falls to 5, stocks will be a bargain again. Then, investors will be disgusted by stocks, not enchanted by them. That’s the dip we want to buy.

|

|

|

The bell tower of Trinity Church in the background, Wall Street in the foreground. Source: Getty Images |

The big news came on Friday. The Wall Street Journal:

JACKSON HOLE, Wyo.—Federal Reserve Chair Jerome Powell opened the door for rate cuts next month when he said the labor market might be softening enough to rein in inflation that is being pushed up by tariffs.

Investors took the hint. Whee! Yahoo! Finance:

Dow jumps 800 points to record, S&P 500, Nasdaq soar as Powell’s Jackson Hole finale fuels bets on September rate cut

This makes the stock market bubblier than ever. And as we pointed out last week, gloomily, all bubbles pop. Our own, unpatented, method for dealing with the risk of a Big Loss is simply to stay away from major stock market allocations until the Dow/Gold ratio sinks to five…then to HODL (hold on for dear life).

There’s nothing magic about ‘5.’ It doesn’t guarantee that stocks won’t go further down, but it assures us that we are at least getting a good deal. Then, we can wait comfortably for the next bull market.

Currently, the ratio is around 13.

Meanwhile, our Doom Index tells us that the economy is holding up …for now. Our ace researcher, Joe Withrow, compiled a list of indicators that should tell us how close we were to a real meltdown. Last week, Joe gave us an update:

Interestingly, the Doom Index ticked up to a ‘12’ rating this month. This puts the index in neutral territory for the first time in over three years.

The primary driver of this uptick was a major surge in loaded imports. After last month’s 12.8% year-over-year increase, imports jumped another 39.2% this month.

Joe adds insight:

Now we have two straight months of rising import volume.

This could be a sign of additional frontloading for certain goods and materials ahead of pending tariff negotiation deadlines. If that’s the case, then this month’s uptick will be short-lived.

However, if we see continued import strength even after upcoming deadlines, that would be a sign that President Trump’s trade deals are not inhibiting the flow of goods. We’ll gain more insight in the months to come.

Imports are a sign of retail buying…which suggests a healthy retail sector. But wait…

There’s always more to the story. Ainvest:

Corrugated Cardboard Box Sales Plummet, Indicating US Retail Demand Correction Ahead

This decline could indicate a correction in retail spending, which makes up almost 70% of the US economy.

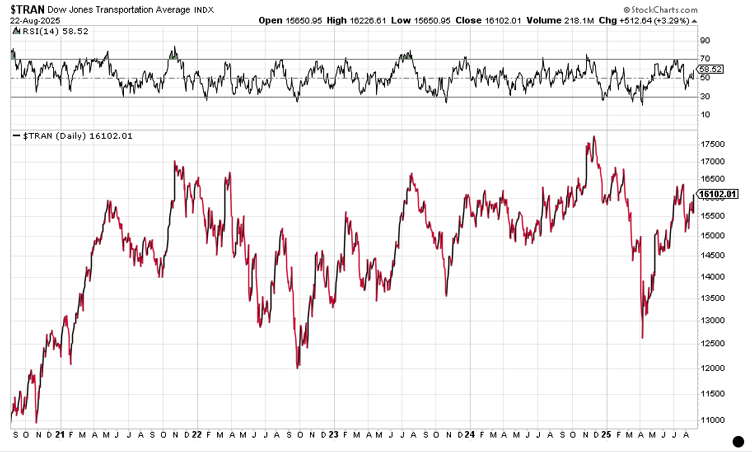

According to classic Dow Theory a downturn in the stock market is not confirmed until the Transports also turn down. Companies can manufacture all they want. But until the product is shipped, there is no sale…no transaction…nothing that would boost the economy.

|

|

|

The Dow Jones Transportation Index has not yet ‘confirmed’ the new all-time high in the Dow Jones Industrial Index. |

But Joe thinks the cardboard market is turning around:

The Cardboard Box Price index is starting to show signs of life. After hitting its lowest level in over 20 years …it has increased slightly in each of the past two months. This signals a slight uptick in global trade and consumer demand.

Joe provides more detail (which you can find in our Monthly Strategy Report to paying subscribers, the next of which, for September, is due out on Wednesday from Tom)…and comes to a conclusion:

In summary, surging imports pushed the Doom Index up to neutral levels this month, but we’re seeing underlying weakness in a number of our other metrics. Caution is still warranted.

The stock market, however, is another thing.

And from Wall Street, we hear bells ringing.

Yahoo! Finance:

Should You Buy the Dip as Palantir Stock Falls for 7 Straight Days?

TipRanks:

Palantir Stock (PLTR) Tumbles 17% From Record High; Here’s How to Buy the Dip Without the Risk

Benzinga:

Palantir Just Broke Below 50-Day Average—Is It Time To Buy The Dip?

This is a bubble mentality. Palantir was selling for 250 times earnings and 90 times sales…real hallucinatory levels. It has come down 20%, but that leaves it still deep in cuckoo land.

And now, almost the entire financial press has a single idea — buy the dip! Even when the dip is no deeper than a wrinkle on a young model’s face.

One day, when the Dow/Gold ratio falls to 5, stocks will be a bargain again. Then, investors will be disgusted by stocks, not enchanted by them. That’s the dip we want to buy.

Regards,

Bill Bonner,

For Fat Tail Daily

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.