Two stocks with “hidden” assets

You might remember we chatted about REITs like SCG last week. Here’s a great example of a company having a business model with another juicy angle to generate value.

Here are two things I’m thinking about today…

1) A surprise special dividend! Hey, who doesn’t love one of these?

One of my recommendations, Lion Selection Group ($LSX), announced this yesterday.

Lion owns a targeted number of names in the junior gold space. Most of its holdings don’t even generate revenue, let alone profits.

What’s the story?

Here’s the cool thing when you dig around a company’s accounts, and get to know them.

Lion had some “legacy” investments it made years ago.

Their communication made clear these were “non core” assets for their new strategy.

And yet, clearly, they still had value.

Here’s what often happens as time goes by. The market ends up placing zero value on old holdings like these. Lion isn’t unique in this regard. It happens all the time, if you watch closely enough.

I made the case for investing in Lion back in my March issue. Lion stock was trading 20% below its net asset backing.

That seemed absurd when it was accumulating junior gold shares cheap at distressed prices…and gold was booming.

I didn’t even care about their old legacy positions. But they had the latent potential to be a free kick somewhere down the line.

One of them just paid off. Lion invested in a firm back in 2012 for just under $3 million.

They just sold it for approximately $12 million. A tidy return.

Hence the special 2c dividend coming for my subscribers, alongside the 27% capital gain in 4 months.

Well done LSX!

We left off yesterday with the idea that junior miners were a place to look for bargains.

LSX is still a nice way to ride this thematic.

Only consider Lion if you’re patient, though. It backs its firms for years as they go from drilling to studies to finance and development.

And, of course, we can’t dismiss the usual risks: commodity bear market, poor investing decisions, etc.

That said, the recent case of Lion’s 2012 investment is a template of what LSX could be doing in around 2030…cashing in some very profitable decisions that they’re making today.

2) Speaking of “hidden” assets, retailing behemoth Scentre Group ($SCG) is another candidate.

It owns all the Westfield shopping centres around the country. That means they own lots of land in key urban areas.

From their release today…

“The Group is one of the largest land holders in the most densely populated areas across metropolitan centres in Australia and New Zealand.

“Mr Rusanow said: ‘Our land holdings could potentially supply a significant number of new dwellings in town centres where people already want to live and work. We are engaging with governments and potential capital partners on how we can realise these housing opportunities across our portfolio.”

You might remember we chatted about REITs like SCG last week. Here’s a great example of a company having a business model with another juicy angle to generate value.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Get the full story here.

There are lots of reasons to like SCG.

Many Aussie shopping centres were built decades ago. They essentially have a monopoly now because land and construction costs are so extreme.

SCG run their centres well. And now they can put housing right where people want to live.

And, yet, just a few years ago, the market placed a low value on all this…

I never recommended this one because it’s not a small cap stock.

But for income investors it’s been a cracking idea. You can probably hold it forever, subject to your ability to cope with market volatility.

Callum Newman,

Small-Cap Systems and Australian Small-Cap Investigator

***

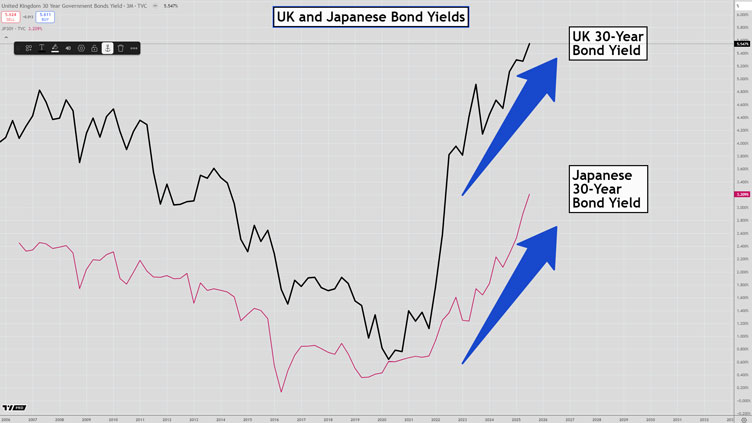

Source: Tradingview

[Click to open in a new window]

There is a curious move going on in UK and Japanese 30-year bonds.

They are getting absolutely hammered.

The Japanese central bank has backed off from their constant intervention in their bond market and yields are rising rapidly looking for the equilibrium level.

Japanese 30-year bond yields have jumped from a totally ridiculous 0.7% yield in 2021 to the current level of 3.20%.

And the uptrend in yields has been accelerating recently.

UK 30-year bond yields just hit their highest level since 1998 at 5.6%. Out of control deficits and inflation fears have seen investors dumping their long bonds.

I have been discussing the steepening of the US yield curve recently as investors demand a higher return for holding bonds for a longer duration.

There are real economic consequences from the long end of the yield curve remaining stubbornly high or rising further.

Mortgage rates are based on 10-year bond yields. Also governments cost of debt will rise dramatically at a time when they need to issue more debt because they remain deeply in deficit.

Japan is the basket case on that front with a debt/GDP above 250%.

If there was any issue that had the ability to explode onto the front of investors’ minds and disrupt the currently bullish outlook it would be a bond market crisis in the UK and Japan.

But conversely it looks odds on that the US Fed will start aggressively dropping interest rates in response to softening employment and a weak housing market.

So there are still opportunities out there.

We jumped into a housing stock in my new international stock trading service, and it jumped nearly 8% on Friday after Fed Chairman Powells Jackson Hole Speech!

Not a bad way to kick off our move away from Australia’s shores and I plan on finding many more like that in future.

Today is your last day to access the service as a founding member with a big discount thrown in, especially if you join for two years.

So make sure you check out what I am up to by midnight tonight when the offer is taken down.

Regards,

Murray Dawes,

Retirement Trader & International Stock Trader

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.