Water: The Ultimate Scarcity Resource

Earlier in the month, I detailed China’s Mega Dam project, which is set to become the world’s largest hydropower project. But I didn’t cover the potential conflict this is set to create.

Michael Burry is famous for calling time on the subprime lending market years before anybody else.

His tale was portrayed in the film The Big Short. Even if you have seen it, it’s worth watching again.

I remember the last time I watched it, and by the end, I wanted to sell every stock I owned!

Getting a bit of market fear back into the nerves could be a good antidote to all the overwhelming bullish sentiment in global markets right now!

Anyway, the final credits of the film infamously finish with the quote:

“The Western world is slowly drinking itself dry.”

Michael Burry believed that water would be the most crucial investment theme in the years to come, focusing on water-rich farmland.

Fresh, clean water is a critical commodity for human and agricultural use, manufacturing, and mining processing.

In fact, one of the big concerns about copper supply stems from the lack of water available to process it at major copper operations.

Processing copper ore is water-intensive, and a lot of mining exists in places that don’t have much water.

Like Chile’s Atacama Desert, a place with the world’s largest copper mines, but one of the driest places on Earth!

But despite the fears, water hasn’t really delivered any major threat to global economies so far.

But that could change soon…

Revisiting China’s Mega Dam

As you might remember, I recently detailed a major infrastructure project—a mega-dam — underway in the Tibetan region of China.

Once completed, this project will surpass the Three Gorges Dam as the world’s largest hydropower operation.

As I explained, that project helped kick-start China’s mighty infrastructure boom of the early 2000s.

The region’s Premier Li Qiang has described this new mega dam in China’s West as the “project of the century.”

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

But what I didn’t focus on in that piece was the project’s LOCATION.

China plans to dam the mighty Yarlung Tsangpo River.

It will do so along a section that drops a mammoth 2,000 metres over 50km creating immense hydropower potential.

But it sits at the doorstep of another superpower

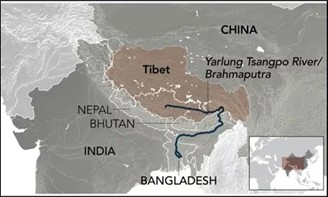

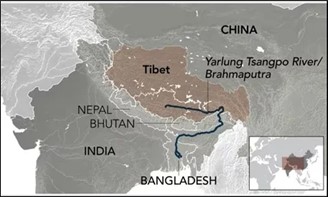

As you can see on the map below, this mighty dam sits directly upstream from China’s neighbours… India and Bangladesh.

|

|

|

Source: Nikkei Asia |

The Yarlung Tsangpo flows south into India, becoming the Brahmaputra River, then into Bangladesh.

But it also flows through a region known as Arunachal Pradesh – a territory claimed by both China and India.

China’s downstream neighbours are concerned about a potential water conflict. And for good reason.

Millions depend on the river for farming, drinking water, and fishing.

New Delhi views the development as a power play by Beijing, extracting enormous economic advantages.

It also fears that China could weaponise its upstream advantage, using the dam to either flood or induce drought over its downstream neighbour.

It’s why India’s Chief Minister recently described the project as a ticking “water bomb”.

Given the global geopolitical backdrop, there’s plenty to consider here, yet few are taking notice.

Two major economies with a history of conflict vying for a critical resource that flows through disputed territory.

Water could soon sit at the heart of major geopolitical turmoil and that could have investment implications: this is the ultimate scarcity commodity.

Opportunities for investors in this arena aren’t easy to find, but they do exist.

That’s what I’ll be revealing soon for my paid readership group at, Diggers & Drillers.

Until next time.

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

James Cooper has been a working geologist in mines across Australia, Canada, and Africa since the early 2000s. He’s led the operations of tiny explorers through to huge producer outfits. He’s seen booms and busts firsthand and he also understands the cyclical nature of individual commodities. For example, James was right there when Barrick Gold launched an enormous $7.5 billion takeover bid for Equinox. That was the peak of the last cycle.

With his background as a geo and finance professional, he brings a unique insight and experience to Fat Tail Investment Research. He writes the broader resource-focused investing letter Diggers and Drillers and the ultra-speculative explorer-focused trading service Mining: Phase One.